Where Are Our Stimulus Checks?

Deprecated: preg_split(): Passing null to parameter #3 ($limit) of type int is deprecated in /home3/contiod3/public_html/chicagodevotion/wp-content/themes/jannah/framework/functions/post-functions.php on line 805

*This article will be updated as new information becomes available to the public. New updates can be found by scrolling to the bottom of the Article.

There is a lot of chatter out there over Who, What, When, Where, How we will receive the promised Stimulus Checks and Direct Deposit Payments from the United Stated Federal Government. We at Chicago Devotion are keeping track of new information and will update this article with the latest news to help you stay informed.

How Much Money Will We Receive?

According to the multiple resources on the IRS Economic Impact Payment website, Eligible Individuals will receive $1,200. If you are married, your eligible spouse will also receive $1,200. You will receive an additional $500 Payment for each qualifying child you claimed on your tax return as long as they meet the following conditions:

- The child is your son, daughter, stepchild, eligible foster child, brother, sister, stepbrother, stepsister, half-brother, half-sister, or a descendant of any of them (for example, your grandchild, niece, or nephew).

- The child is claimed as a dependent on your tax return.

- The child was under age 17 at the end of the taxable year.

- The child was a U.S. citizen, U.S. national, or U.S. resident alien.

- The child has a valid SSN or an Adoption Taxpayer Identification Number (ATIN)

What Does An “Eligible Individual” Mean? Am I Eligible?

“Eligible Individuals” means you earn and report between $0 – $75,000 per year on your taxes as an individual, $112,500 for taxpayers filing as head of household, or $150,000 for taxpayers filing a joint return. Basically, if you make less than these amounts, you will get the full $1,200 per single adult, $2,400 total per married couple, and $500 for each qualifying child.

It gets a little more complicated from here.

Per the IRS website, If you make more than these amounts per year, the Payment amount is reduced by 5% of the amount that your adjusted gross income exceeds those amounts until your eligibility is $0.

The $1,200 Payment for eligible individuals with no qualifying children ($2,400 for married couples filing a joint return) will be reduced to $0 once adjusted gross income reaches the following thresholds:

- $198,000 for taxpayers filing a joint return

- $136,500 for taxpayers filing as head of household

- $99,000 for all others

Each of these threshold amounts increases by $10,000 for each additional qualifying child. For example, because families with one qualifying child receive an additional $500 Payment, their $1,700 Payment ($2,900 for taxpayers filing a joint return) will be reduced to $0 once adjusted gross income reaches the following thresholds:

- $208,000 for taxpayers filing a joint return

- $146,500 for taxpayers filing as head of household

- $109,000 for all others

Still with us? Good. There are a lot of rules here about the Stimulus Checks, so don’t feel bad if you had to read all that twice — I did too.

Will I Receive A Payment If I do Not Make Enough Money To Have To File A Tax Return?

Yes. Eligible retirees and recipients of Social Security retirement, disability (SSDI), survivors benefits, Railroad Retirement, or veterans benefits, as well as individuals who do not make enough money to normally have to file a tax return, are also eligible for the Payment.

This includes those who have no income, as well as those whose income comes entirely from federal benefit programs, such as supplemental security income (SSI) benefits. No minimum income is needed for the Payment.

You also do not need to file a tax return if you make less than a certain amount per year. Though you should, even if it’s $0. Use this handy tool on the IRS website to find out if you need to file a return every year.

How Do I Get My Money?

If you have filed a 2018 or 2019 tax return and entered your banking information, you will automatically receive the money direct deposited into your bank account.

If you did not receive a refund for these years and did not enter your banking information, you can use the IRS Get My Payment tool to enter your banking information so you can get in line to receive a direct deposit and do not have to wait on a paper check.

You can also use the Get My Payment tool to track the progress of your stimulus checks.

If you did not file a tax return in 2018 or 2019, or you did not have to, you can use the IRS Non-Filers: Enter Payment Info Here tool to enter your banking information.

If My Only Income Is From Social Security / Social Security Supplemental / Disability / Veterans Affairs / Railroad Retirement Benefits, When Will I Receive A Payment?

You can check the IRS Economic Impact Payment website for all the facts, and the IRS Get My Payment tool to check your payment status every day.

Per the IRS: “Individuals who receive Social Security retirement or disability benefits, or who receive Railroad Retirement benefits but didn’t file a return for 2019 or 2018 will automatically receive a stimulus check in the “near future.”

Paper stimulus checks to Social Security recipients will begin to go out in late April.

Will I Have To Pay The Money Back?

No. The stimulus payment is actually a refundable credit against your 2020 tax liability and is paid out as an advanced refund.

When Will I Receive My Stimulus Payment Paper Check?

If you cannot receive a direct deposit or cannot enter your information through the IRS Get My Payment Tool, you will receive a paper stimulus check in the next few months.

According to the U.S. Treasury Department, they are currently able to print about 5 million paper checks a week, which means it may take up to 120 weeks (5 months) to print and mail paper stimulus checks to all Americans who will not receive direct deposit payments.

Paper checks are scheduled to begin printing sometime next week.

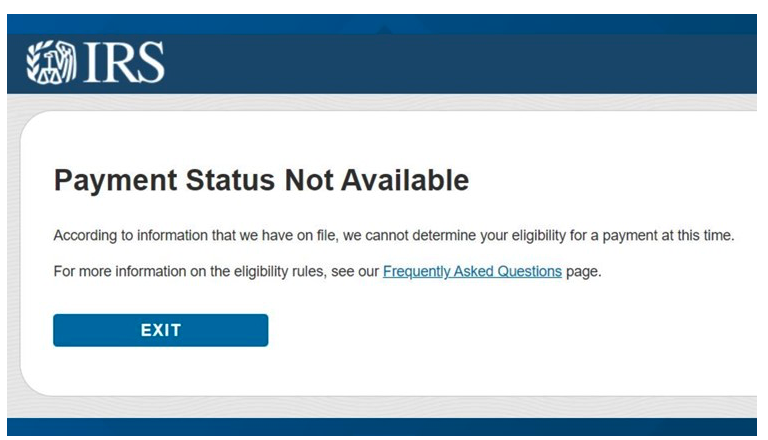

I Tried To Use The IRS Get My Payment Tool, But I Got An Error Message That Said “Payment Status Not Available.”

The Washington Post published a great article here on this issue and other Stimulus Payment glitches.

Basically, this is due to a number of things happening all at once: Many Americans’ tax information has not been entered into the system yet, millions of Americans are trying to access the website at once and causing connection issues, or many Americans filed their taxes digitally through a tax service and acted as the middle man for their refunds, causing direct deposit information issues.

Also, if you check the Get My Payment tool more than 3 or 4 times in one day, they may lock you out of using the system for 24 hours. This is to discourage people from checking it all the time and overloading the system. They update the system with new taxpayer information overnight, every night, so you only need to check it once a day.

*UPDATE: MAY 4, 2020

To date, over 100 million out of the approximately 150 million Americans who are eligible for stimulus money have received direct deposits or paper checks. Those of you who are still waiting on your stimulus money may fall into one of the following categories:

If you receive monthly Social Security payments by direct deposit or paper checks in the mail, May is likely your month. If you receive your money by direct deposit, direct deposits will begin to be deposited into your accounts this week – so check your bank balances over the next week or two. If you receive a paper check in the mail every month, your stimulus paper check could arrive anytime from next week to late May.

Supplemental Security Income (SSI) and low-income Veterans who receive pensions from the Department of Veterans Affairs can expect to receive their stimulus money by the end of May, even if you don’t have to file tax returns.

If you do not fall into these categories, and you have not been able to enter your direct deposit information into the IRS’s Get My Payment tool, you may be in for a longer wait. Currently, the government is able to process around 5 million paper checks per day, and it could take up to 5 months (September) for all the checks to be processed and mailed.

The paper checks are being sent in order of lowest reported income to the highest, which means they will start mailing out the paper checks for those who had zero income in 2018 and/or 2019, and those reporting $99,000 in income will receive their checks last.

You can try to use the IRS’s Get My Payment tool to add your direct deposit information, but you may not be entered into the system yet. They are working on that. If you try to enter your information into the tool and get the Dreaded “Payment Status Not Available” Message, keep checking back every day because the system is updated overnight, every day. Your information may pop up soon.

If you were not required to file a tax return in 2018 or 2019, you can input your personal and banking information into the IRS’s Non-Filer tool here.

Those who are able to enter their direct deposit information into they Get My Payment or the Non-Filer tools still have to wait for their information to be processed. Currently, the cutoff time for each week is every Tuesday at noon, Eastern Time, and those who are able to enter their information by that cutoff may see deposits in their bank accounts as soon as the following weekend. If you are finally able to enter your direct deposit information after the Tuesday noon cutoff, your deposit will be processed the following week.

*UPDATE: JUNE 1, 2020

The U.S. Treasury Department has announced that approximately 4 million Americans will receive their Economic Impact Payments in the form of a prepaid debit card instead of a paper check.

These debit cards will be sent to Americans for whom the IRS does not have banking information on file, and who may have filed tax returns that have not yet been processed or have been processed by two specific IRS branches: Andover, Massachusetts and Austin, Texas.

*If you receive a plain white paper envelope from METABANK with a debit card inside, DO NOT THROW IT AWAY. It contains your Economic Impact Payment loaded onto the prepaid debit card enclosed.

Many Americans who have received these cards have mistaken the plain content and card as junk mail and thrown them away, shredded them, or cut them up. With all the junk mail, debt consolidation calls, scam calls, scam emails we receive these days, I completely understand their reaction.

Follow the enclosed instructions to activate your prepaid debit card, as it has to be activated before you can use it. These cards can be used just like a regular debit card: you can make purchases, get cash from in-network ATMs, or transfer funds up to $2,500 to your personal bank accounts without any fees. The cards can be used at any location that accepts Visa cards.

BUT, there’s a catch. If you lose the card, there is a $7.50 fee to replace it. If you want the new card expedited, that’ll cost another $17.

For more information, including step-by-step instructions on how to activate and use the card, visit this extremely helpful Consumer Financial Protection Bureau’s website page to find answers to any additional questions you may have.

Once you have your card, go to www.EIPcard.com to check your balance, transfer money to your bank accounts, or transfer the balance to another prepaid card.

Keep coming back every day. Set Chicago Devotion as your home page to stay informed, and follow us on Facebook and Twitter to stay in the know. #WeAreChicagoDevoted!

Bookmark us at www.ChicagoDevotion.com to stay informed and get involved with your online community for the information, resources, forums, job listings, and help you need now.